Here’s today’s ‘Just A Minute’ bringing you a 60 second summary of what’s happening in the markets:

Main Trading Events Of The Day: USD PPI m/m @ 12.30 & USD Prelim UoM Consumer Sentiment @ 13.55 GMT

WHAT WE’RE WATCHING TODAY

Markets Await US PPI & Consumer Sentiment Reports

With U.S. PPI data due later today, the government will probably report that wholesale prices rose a mild 0.2% in February to match the increase in January. Wholesale prices reflect the costs that companies pay for raw or semi-finished products and services before they sell them to consumers. The government has revamped the produce price index to include the cost of services, government purchases, exports and construction. The old PPI only included wholesale goods and covered just a small portion of all goods and services produced in the United States. The first PPI compiled under the new formula showed basically no change in inflationary patterns in January. Wholesale prices have risen just 1.2% in the past 12 months.

Consumer sentiment forecasts reveal slight differences. According to a Thomson Reuters report, the consumer sentiment survey for March is forecast to fall slightly to 80.8 from 81.6 in February. Over the past year the survey has ranged from a high of 85.1 in July to a low of 73.2 in October. Another report predicts a rise of 0.4 points to 82.0, based on the fact that weekly consumer confidence indicators improved into March with the Bloomberg Consumer Comfort Index for the week ending March 2 showing its strongest level since the beginning of January. Higher gasoline prices may weigh on sentiment, but equity indices have moved higher since the end of February which likely boosted the consumer outlook at the beginning of the month.

USD PPI m/m @ 12.30 & USD Prelim UoM Consumer Sentiment @ 13.55 GMT

Gold Hits Fresh Six-Month Highs On Ukraine/China Worries

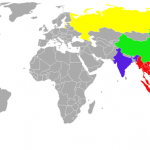

Gold rose to fresh six-month highs on Friday heading for its biggest weekly gain in four weeks, supported by increasing tensions between Russia and the West over Ukraine and worries over an economic slowdown in China. The metal has gained nearly 3 percent this week, marking its sixth straight weekly rise, as investors exited riskier assets such as equities. While money flowing into gold-backed exchange-traded funds has increased, reflecting confidence in the metal’s outlook, physical demand has slowed as higher prices put off buyers, making some cautious about how long the rally can last. Demand in China, the world’s biggest bullion consumer, has fallen with prices on the Shanghai Gold Exchange about $3 an ounce lower than London prices, compared with a premiums of over $20 earlier this year. Physical buying in other Asian regions has also slowed, with some selling to make a profit from rising prices. Gold is getting its biggest support from the crisis in Ukraine. Data on Thursday showed China’s economy slowed markedly in the first two months of the year, with growth in investment, retail sales and factory output all falling to multi-year lows.

Next From Apple: A Pedometer That Never Misses Steps?

With a constant stream of innovative tech releases, it’s always interesting to keep any eye on Apple stocks. So, what’s next on Apple’s agenda? According to reports, the next big release that Apple has up its sleeve is a smart pedometer. Documents released Thursday at the U.S. Patent and Trademark Office show that the company is working on a device to more accurately measure a person’s movement, presumably for a health-monitoring wearable device. Apple is expected to take the iWatch mainstream and expects it to reach the public later in 2014. The patent covers a smart wrist-mounted pedometer that can automatically determine its location on a user’s body and compensate for missed steps using advanced processing algorithms. Analysts are looking for the tech giant whose stock is down slightly from the beginning of the year to introduce new product categories to excite buyers again. Keep an eye on those Apple stocks!

That sums up today’s highlights! Don’t forget to keep up with all the latest market developments via our social media channels! We hope you have a profitable day on the markets and a great weekend - we’re back on Monday!